为了帮助广大ACCA考生在9月份的ACCA考场上发挥自如,更有把握通关ACCA考试,中国ACCA考试网特别将ACCA官方发布的2016年ACCA试题进行了整理,特别发布了出来,今天给大家带来的题目如下,我们之所以在最后考前冲刺阶段再次整理发布这些试题,仅仅是为了帮助广大ACCA考生进行最后的查漏补缺,希望我们的努力可以帮助到您。

Question:

On 1 October 2015,Zanda Co acquired 60%of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co.In addition,Zanda Co will pay a further$0·54 per acquired share on 30 September2016.

Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8%per annum.The market value of Zanda Co’s shares at 1 October 2015 was$3·00 each.

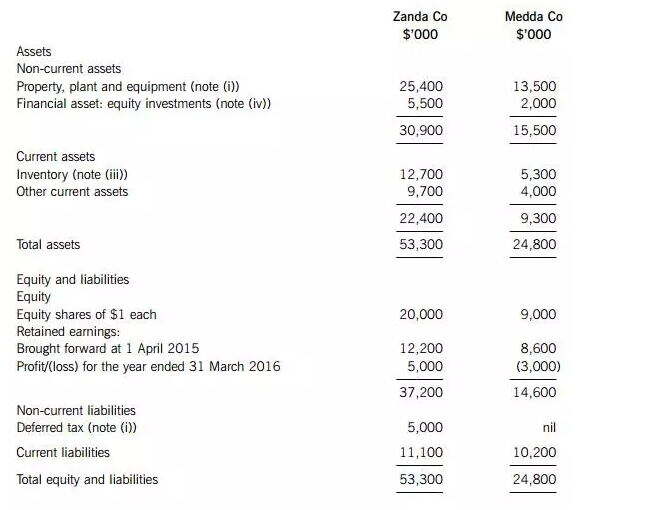

The summarised statements of financial position of the two companies as at 31 March 2016 are:

The following information is relevant:

① At the date of acquisition,Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts(including Medda Co’s financial asset equity investments)with the exception of an item of plant which had a fair value of$2·5 million below its carrying amount.The plant had a remaining useful life of 30 months at 1 October 2015.

The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of$1·2 million at 1 October2015,relating to Medda Co’s losses,can be relieved in the near future as a result of the acquisition.At 31 March2016,the directors’opinion has not changed,nor has the value of the deferred tax asset.

② Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition.For this purpose,a share price for Medda Co of$1·50 each is representative of the fair value of the shares held by the noncontrolling interest.

③ At 31 March 2016,Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35%.These goods had cost Medda Co$2·43 million.

④ The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 2015.

At 31 March 2016,these had fair values of$6·1 million and$1·8 million respectively,with the change in Medda Co’s investments all occurring since the acquisition on 1 October 2015.

⑤ There is no impairment to goodwill at 31 March 2016.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March2016:

① Goodwill;

② Retained earnings;

③ Non-controlling interest.

The following mark allocation is provided as guidance for this question:

① 6 marks

① 6 marks

② 7 marks

③ 2 marks

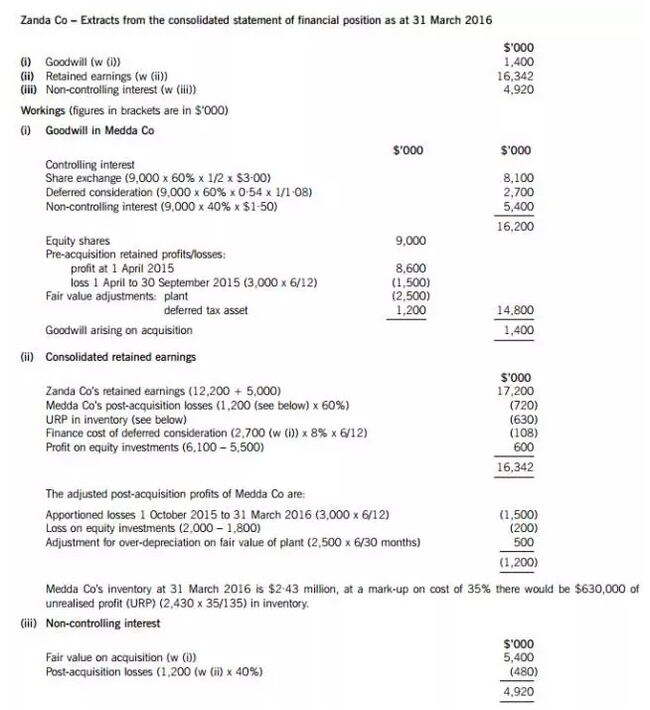

Answer:

Answer:

ACCA考试指南

ACCA考试指南

发布时间:2022-07-15

发布时间:2022-07-15

复制本文链接

复制本文链接 模拟题库

模拟题库

174

174