迎战2017年6月份ACCA考试,你准备好了吗?

ACCA F6的公式更新出炉啦~

Sdanvi老师为大家操碎了心...

火速整理最全ACCA F6公式!

让你的ACCA冲刺阶段,火力全开!

Income Tax Liability

1.Adjusted net income=net income-gross PPS-gross gift aid donation

2.Personal allowance

Std PA=£11,000

When'Adjusted net income'≥£100,000

Std PA 11000

Less:restriction(adjusted net income-100000)*1/2

Adjusted PA

'Adjusted net income'≥£122000,PA=0

3.Gift aid donation

•Gross up=net gift aid donation*100/80

•Extending the rate band

32000(150000)+gross gift aid donation

•Adjusted net income=net income-gross gift aid donation

4.Child benefit income tax charge:

When£60,000≥'Adjusted net income'≥£50,000

%=(Adjusted net income-50000)/100 Round down

child benefit income tax charge=%*child benefit received

5.Authorized mileage allowances

2.Personal allowance

Std PA=£11,000

When'Adjusted net income'≥£100,000

Std PA 11000

Less:restriction(adjusted net income-100000)*1/2

Adjusted PA

'Adjusted net income'≥£122000,PA=0

3.Gift aid donation

•Gross up=net gift aid donation*100/80

•Extending the rate band

32000(150000)+gross gift aid donation

•Adjusted net income=net income-gross gift aid donation

4.Child benefit income tax charge:

When£60,000≥'Adjusted net income'≥£50,000

%=(Adjusted net income-50000)/100 Round down

child benefit income tax charge=%*child benefit received

5.Authorized mileage allowances

Up to 10,000 miles 45p

over 10,000 miles 25p

6.Additional charge of living accommodation benefit

6.Additional charge of living accommodation benefit

Additional benefit=(cost of providing accommodation–£75,000)×the official rate of interest

which is time apportionment

7.Benefit of use of assets

7.Benefit of use of assets

The benefit assessed is the higher of

-20%x(MV when first provided–the price paid by employee)

-rental paid by employer(if asset is rented)

which is time apportionment

8.Benefit of gift of assets

8.Benefit of gift of assets

If new asset is given:cost of the asset

If used assets is given:higher of

-(MV when given–the price paid by employee)

-(MV when first provided–benefits already assessed–the price paid by employee)

9.Benefit of provision of a car

9.Benefit of provision of a car

Taxable car benefit=X%*(list price–capital contribution)*time proportion–payment by employee for use of the car

Emission≤50 g/km,X=7%

Emission≤50 g/km,X=7%

51≤Emission≤75 g/km,X=11%

76≤Emission≤94g/km,X=15%

Emission=95g/km,X=16%

Emission>95g/km,increase by 1%for every 5 g/km increase

X=(Emission-95)/5 Round down

diesel cars:+3%

Maximum:37%

10.Benefit of Provision of fuel

10.Benefit of Provision of fuel

X%*£22,200 which is timeapportionment

11.Provision of vans

11.Provision of vans

Standard benefit of£3,170

£598 a year for private fuelwhich is time apportionment

12.PPS

12.PPS

Grossup=net PPS*100/80

Extending the rate band

32000(150000)+gross PPS

Adjusted net income=Netincome-gross PPS

13.OPS

13.OPS

Employer’scontributions:trading profit-OPS

Employee’scontributions:employment income-OPS

14.Furniture replacement relief

14.Furniture replacement relief

Furniturereplacement relief=MV of new furniture(same function)-resale value of oldfurniture

15.Rent a room

15.Rent a room

Gross rental income<=£7500,lower of

-Property business income=0

-Property business income=normal calculation=gross rent–expenses–Furniture replacement relief

Gross rental income>£7500,lower of

-Property business income=normal calculation or,

-Property business income=alternative calculation=gross rent-7500

16.Premium

16.Premium

Landlord:

Premium is treated asproperty business income for the year of grant.

P-P×2%(n-1)

Where:P=total premium

n=duration of lease in years

Tenant:premium paid is treated as a tradingexpense(proportioned to mont

| P-P×2%(n-1) * | m |

| n | 12 |

17.Class 1 NIC(on cashearnings)

Primary:

£1-£8,060per year Nil

£8,061-£43,000per year 12%

£43,001 and above per year 2%

Secondary:

£1-£8,112per year Nil

£8,113and above per year 13.8%

18.Class 1A NIC(on taxablebenefits)

18.Class 1A NIC(on taxablebenefits)

=taxablebenefits*13.8%

19.Class 2

19.Class 2

=£2.8*weeks

20.Class 4(on trading profit:which is after loss relief)

20.Class 4(on trading profit:which is after loss relief)

£1-£8,060per year Nil

£8,061-£43,000per year 9%

£43,001 and above per year 2%

21.Payment of tax

21.Payment of tax

for 16/17:

-31.1.17-first payment onaccount=1/2*(15/16 income tax payable+15/16 NIC Class 4)

-31.7.17-second payment onaccount=1/2*(15/16 income tax payable+15/16 NIC Class 4)

-31.1.18-final balancing payment=16/17 income tax payable+16/17 NIC Class 4 tax-(15/16income tax payable+15/16 NIC Class 4)+16/17CGT+16/17 Class 2

Payment ofcapital gain tax:31.1.18for 16/17

Payment ofClass 2:31.1.18for 16/17

22.Interest on late payment of tax:3%*due amount(which is time apportionment)

22.Interest on late payment of tax:3%*due amount(which is time apportionment)

POAs-runs from 31.1.2017/31.7.2017

Final payment-runs from 31.1.2018

23.Penaltyon late balancing payment:

23.Penaltyon late balancing payment:

-no more than 1 month,0

-no more than 6 month,5%,(5%*(shouldpay-actual pay))

-more than 6 months,10

-more than 12 months,15%

24.Penaltiesfor late return:

24.Penaltiesfor late return:

-thereturn filed after the filing date,100

-morethan 3 months,10 per day,at most 90 days

-morethan 6 months,higher of 5%*tax due on return&300

-morethan 12 months,higher of 100%/70%/5%*tax due on return&300

CGT

1.Transfers between spouses/civil partner(A→B)

A:

A:

less:cost

deemed proceeds:

less:rollover relief

Gain taxed now(0)

B:

base cost=deemed proceeds-rollover relief

2.Partial disposal

2.Partial disposal

| Proceeds | A |

| Less:selling costs | (X) |

| X | |

| Less: | |

| original cost*A/(A+B) | (X) |

| Chargable gain | X |

A–MV of the part disposed of

B–MV of the remaining part of the asset

3.Damaged asset

3.Damaged asset

A

A+B

A=compensation received

B=unrestored value of asset

4.Destroyed assets

4.Destroyed assets

Compensation received

Less:cost

Less:rollover relief

Gain taxed now(not reinvest)

Base cost of the new asset=MV of the new asset-rollover relief

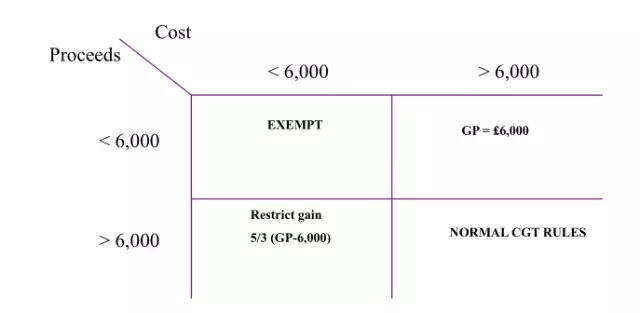

5.Non wasting chattels(antiques and paintings)

5.Non wasting chattels(antiques and paintings)

6.Wasting assets(copyright)

Remaining cost is the key part in the computation

For example,if a taxpayer acquires a wasting asset with a remaining life of 40 years and disposes of it after 15 years,so that 25 years of useful life remain,only 25/40 of the cost is deducted in the computation.

7.Principal private residence

7.Principal private residence

PPR relief is calculated as

Gain*period of occupation/period of ownership

The letting relief is the lowest of

The gain arising in the letting period not covered by PPR relief

£40,000

The PPR relief already given

8.Valuing quoted shares

8.Valuing quoted shares

lower of:

the‘quarter-up’value:lower quoted price+1/2×(higher quoted price–lower quoted price)

the average of the highest and lowest marked bargains(ignoring bargains marked at special prices)

9.Cost of shares(matching rules)

9.Cost of shares(matching rules)

Acquisitions on the same day

Acquisition in the next 30 days–FIFO basis

Shares in the share pool

Proforma of share pool

| Share pool | NO. | Cost |

| Additions | X | X |

| Disposals | (X) | X |

| X | (X) |

10.Takeover

| Proceeds(cash received) | A |

| Less: | |

| original cost*A/(A+B) | (C) |

| Chargable gain | X |

where:

A=cash element and;

B=value of non cash element i.e market value at date of takeover

11.Gift relief

11.Gift relief

Assets qualifying:

Business assets

Unquoted shares in a trading company

Quoted shares in a personal trading company(>5%)

A:

Deemed proceeds:

less:cost

less:gift relief

Gain taxed now(actual gain)

B:

base cost=deemed proceeds-gift relief

If the company has chargeable non-business assets at the time of the gift

gift relief will be:

Total gain×MV of CBA/MV of CA

CBA=chargeable business assets(chargeable assets except investments)

CA=chargeable assets(assets not exempt from CGT)

12.Replacement of Business Assets

12.Replacement of Business Assets

Proceeds of old asset

Less:cost

Less:rollover relief

Gain taxed now(not reinvest)

Base cost of the new asset=MV of the new asset-rollover relief

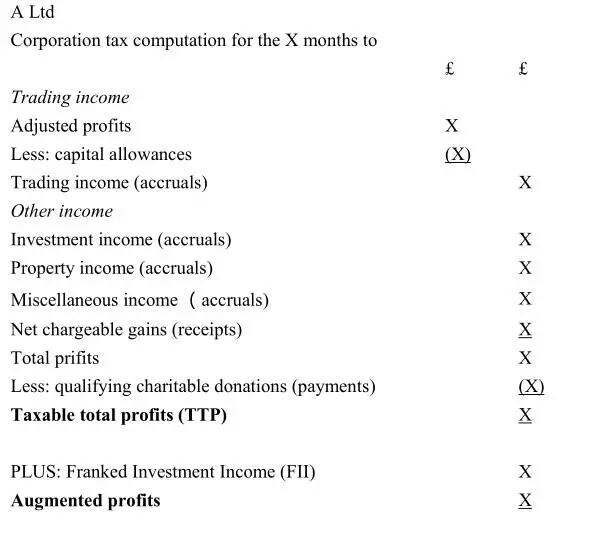

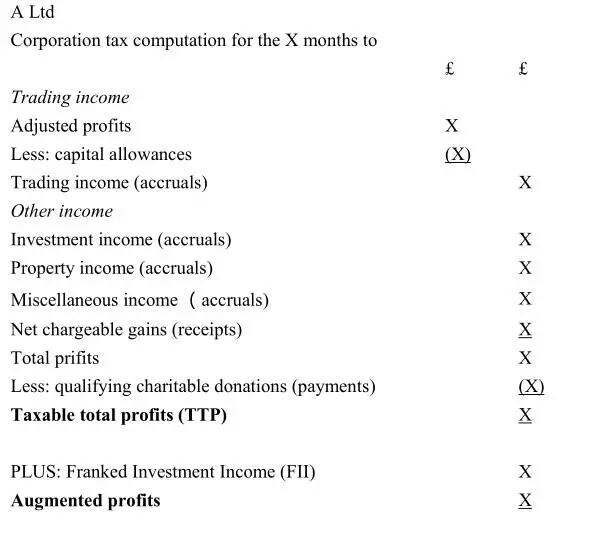

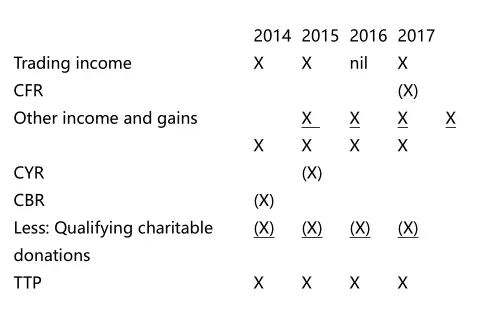

Corporation tax liability

1.Proforma

2.Computing the corporation tax liability

2.Computing the corporation tax liability

Corporation tax payable is calculated as:

TTP*CT rate for the financial year

4.Chargeable Gains for Companies

4.Chargeable Gains for Companies

proceeds:

less:incidental cost on disposal

net proceeds

less:cost

capital exp.(enhancement cost)

gain

less:

indexation allowance on cost

cost*(RPI卖-RPI买)/RPI买

indexation allowance on enhancement cost

enhancement cost*(RPI卖-RPI提)/RPI提

indexed gain

5.Matching rules for shares-companies:

5.Matching rules for shares-companies:

same day

9 days prior to disposal

FA1985 pool:from 82.4.1 to 10 days prior to disposal(IA should be considered)

6.Trading losses

6.Trading losses

7.Self-assessment and payment of tax by large companies

Installments are based on expected current year’s liability.

The four quarterly installments will be made in months 7,10,13 and 16 following the start of the accounting period.The installments are due on the 14th of the month.

If an accounting period is less than 12 months

Each installment=3×CT/n(n=no.of months in AP).

Final installment always due by 14th of the 4th month following end of accounting period.

Inheritance tax

1.lifetime tax(1)CLT(donee pays tax)

donee pays tax

step1:7 yrs accumulation of other CLTs(tranfer date转让日往前7年内)

step2:nil rate band available(nil rate band at transfer year-7 yrs accumulation)

step3:value of CLT(after exemptions)

step4:calculate the IHT using 0%/20%

(2)CLT(donor pays tax)

donor pays tax

step1:7 yrs accumulation of other CLTs(tranfer date转让日往前7年内)

step2:nil rate band available(nil rate band at transfer year-7 yrs accumulation)

step3:net value of CLT(after exemptions)

step4:calculate the IHT using 0%/25%

step5:gross value of transfer(net value of transfer+IHT paid by donor)

2.Death tax on Lifetime transfer if the donor dies within 7 yrs of making a PET/CLT,then the PET&CLT will need to calculate an additional death tax.

step1:7 yrs accumulation of PETs and gross value of CLTs if donor pay the lifetime tax(transfer date转让日往前7年内)

step2:nil rate band available(325000 death year nil rate band-7 yrs accumulation)

step3:Gross value of CLT/PET

step4:calculate the IHT using 0%/40%

step5:reduce the taper relief(if available)

step6:deduct any lifetime tax already paid

6.Death tax on death estate

step1:7 yrs accumulation of PETs and gross value of CLTs if donor pay the lifetime tax(death date往前7年内)

step2:nil rate band available(325000 death year nil rate band-7 yrs accumulation)

step3:value of death estate

step4:calculate the IHT using 0%/40%

7.Value of death estate Value of death estate:ALL ASSETS

except for:

mortgaged asset(endowment mortgage is not deducted)

legally enforceable debts(verbally promised is not deducted)

funeral expense

spouse exemption

Value added tax

1.VAT=VAT exclusive amount×20%2.VAT=VAT inclusive amount×20/120

3.VAT inclusive amount=VAT exclusive amount×120/100

4.Cash discount

Output VAT=sales revenue*(1-x%discount)*20%

Adjustment is made if discount subsequently does not apply.

5.VAT on fuel the company only paid the business part:

input VAT=business fuel*20%

the company paid all fuel(business&private),however employee reimburse all the private fuel

input VAT=full amount*20%,output VAT=private fuel*20%

the company paid all fuel(business&private),and employee does reimburse all the private fuel:

input VAT=full amount*20%,output VAT=Scale charge*20%

6.Flat rate scheme

flat rate percentage*tax inclusive income(std+zero+exempt supplies).

ACCA题库,戳:ACCA题库【手机可刷+全球题库】(按照知识点进行分类配题,有知识点没有搞懂,无法解锁,直至掌握,目前阶段免费)

声明丨本文由中国ACCA考试网整理发布,经Sdanvi老师许可,微信公众号“ACCA学习帮”授权,未经原作者许可和原出处授权不得随意转载引用,如有侵权将依法追究责任。

考经分享

考经分享

发布时间:2019-10-28

发布时间:2019-10-28

复制本文链接

复制本文链接 模拟题库

模拟题库

105

105